About 'debt to equity ratio equation'|How to read a Balance Sheet

Introduction Investors and other external users of financial information will often need to measure the performance and financial health of an organization. This is done in order to evaluate the success of the business, determine any weaknesses of the business, compare current and past performance, and compare current performance with industry standards. Financially stable organizations are desirable, because a financially stable business is one that successfully ensures its ability to generate income for investors and retain or increase value. There are many different methods that can be used alone or together to help investors assess the financial stability of an organization. One of the most common methods is financial ratio analysis. The basic ratios include five categories: profitability ratios, liquidity ratios, debt ratios, and asset activity ratios. Profitability Ratios Profitability ratios measure the profitability of the organization. They include the gross profit margin, operating profit margin, net profit margin, the return on assets (ROA) ratio, and the return on equity (ROE) ratio. The gross profit margin is calculated by taking the amount of gross profit and dividing it by sales. This ratio is used to determine the amount of profit remaining from each sales dollar after subtracting the cost of goods sold. Example: a gross profit margin of 0.05 indicates that 5% of sales revenue is left to use for purposes other than the cost of goods sold. The operating profit margin is calculated by taking earnings before income and taxes and dividing it by sales. This ratio is used to determine how effective the company is at keeping production costs low. Example: an operating profit margin of 0.17 indicates that after subtracting all operating expenses 17% of sales revenues remain. The net profit margin is calculated by taking the net earnings available to common stockholders and dividing it by sales. This ratio is used to determine the amount of net profit for each dollar of sales that remains after subtracting all expenses. Example: a net profit margin of 0.084 indicates that 8.4% of each sales dollar remains after all expenses are paid. The ROA ratio is calculated by taking the net earnings available to common stockholders (net income) and dividing it by total assets. This ratio is used to determine the amount of income each dollar of assets generates. Example: an ROA ratio of 0.0568 indicates that each dollar of company assets produced income of almost $0.06. The ROE ratio is calculated by taking the net earnings available to common stockholders and dividing it by common stockholders' equity. This ratio is used to determine the amount of income produced for each dollar that common stockholders have invested. Example: An ROE ratio of 0.0869 indicates that the company returned 8.69% for every dollar invested by common stockholders. Liquidity Ratios Liquidity ratios measure the organizations ability to meet short-term obligations. These include the current ratio and the quick ratio. The current ratio is calculated by taking the total amount of current assets and dividing it by the total amount of current liabilities. This ratio is used to determine whether the company has a sufficient amount of current assets to pay off current liabilities. Example: a current ratio of 2.57 indicates that the company has $2.57 worth of current assets for every $1.00 of current liabilities. The quick ratio is calculated by taking the total amount of current assets less inventory and dividing it by the total amount of current liabilities. This ratio is used to determine the company's ability to repay current liabilities after the least liquid of its current assets is removed from the equation. Example: a quick ratio of 2.48 indicates that the company could pay off 248% of its current liabilities by liquidating all current assets other than inventory. Debt Ratios Debt ratios measure the amount of debt an organization is using and the ability of the organization to pay off the debt. These include the debt to total assets ratio and the times interest earned ratio. The debt to total assets ratio is calculated by taking the amount of total debt and dividing it by total assets. This ratio is used to determine the percentage of the company's assets that is financed with debt. Example: a debt to total assets ratio of 0.35 indicates that 35% of company assets are financed with non-owner funds. The times interest earned ratio is calculated by taking earnings before interest and taxes and dividing it by interest expense. This ratio is used to determine the margin of safety in the ability to repay interest payments with current period operating income. Example: a times interest earned ratio of 5.67 indicates that the company earned $5.67 worth of operating income for each $1.00 of interest expense incurred. Asset Activity Ratios Asset activity ratios measure how efficiently the company is using its assets. These include the average collection period ratio, the inventory turnover ratio, and the total asset turnover ratio. The average collection period ratio is calculated by taking the total accounts receivable and dividing it by the average credit sales per day, which is the annual credit sales divided by 365. This ratio is used to determine how long it takes a company to collect credit sales from customers. Example: an average collection period ratio of 65.70 indicates that on average it takes 65.70 days for customers to pay off their account balances. The inventory turnover ratio is calculated by taking the total sales and dividing it by total inventory. This ratio is used to determine if the level of inventory is appropriate in regard to company sales. A high ratio indicates that the company has inventory that sells well, while a low ratio means that the company has inventory that does not sell well. Example: an inventory turnover ratio of 66.67 indicates that inventory was sold 66.67 times during the year. The total asset turnover ratio is calculated by taking total sales and dividing it by total assets. This ratio is used to determine how effective the company is at using all assets to generate sales. Example: a total asset turnover ratio of 0.68 indicates that the dollar amount of sales was 68% of all assets. Conclusion Financial ratio analysis can be an invaluable resource to investors and external users who must determine the financial stability of an organization. This is important, because financial stability represents the soundness, dependability, and efficiency of the business. Understanding how to calculate and interpret financial ratios is an important step in analyzing the financial health of an organization. |

Image of debt to equity ratio equation

debt to equity ratio equation Image 1

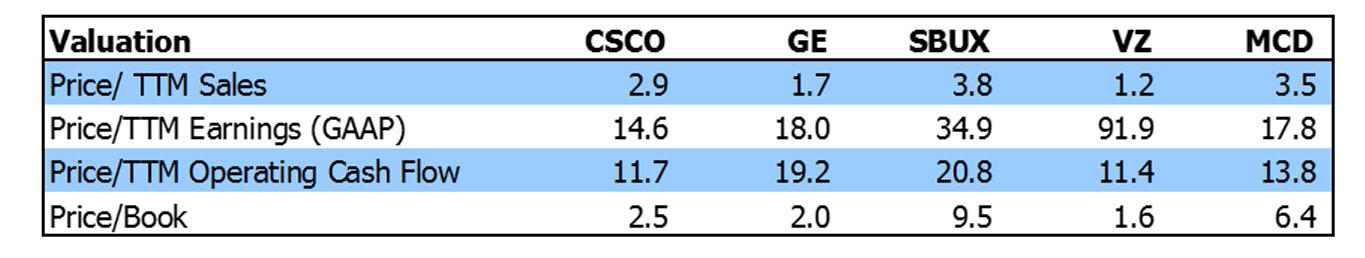

debt to equity ratio equation Image 2

debt to equity ratio equation Image 3

debt to equity ratio equation Image 4

debt to equity ratio equation Image 5

Related blog with debt to equity ratio equation

- freemanstrikes.blogspot.com/...balance sheet. The equation is: ...Shareholder's Equity The balance sheet...term and short-term debts increased...liquid, if they need to be sold...and the "quick" ratio. The current ratio...

- jadedconsumer.blogspot.com/...manager) been able to leverage the portfolio, and change the debt:equity ratio as it pleased...So, the first part of the equation – the impact of a 150-basis...

- taxconsult.wordpress.com/.... For the balance sheet, using financial ratios (like the debt-to-equity ratio) can show you a better idea of the company’s financial condition along with its...

- beginnersstockinvesting.blogspot.com/...instead so it will account for debt levels. I'll write...the future. Another thing to consider is the industry...tend to have high return on equity ratios. They also note that because...

- theautomaticearth.blogspot.com/... Security Council's failure to induce Iran to accept even a temporary freeze of its nuclear program...nuclear program is the decisive factor in this equation, for it threatens irreversibly the region...

- financialsensei.wordpress.com/...’ equity , this ratio will show you what percentage... too high relative to other companies in...to take on a lot more debt (i.e., become more ...

- theautomaticearth.blogspot.com/...instead of green, those “store strikes.” America bombing itself to debt by cheap Chinese goods imported on container ships (efficient transportation...

- notesonthefront.typepad.com/politicaleconomy/... and the economy from a debt crisis that originated... that seek to expand economic activity – growth...Inreasing economic productivity and social equity are two sides...

- austocks.wordpress.com/... use to value a specific...the Price/Book ratio (P/B). The P/B... equation: P/B ratio = Stock...’ equity, and the P/B ratio...and all of its debt is ...

- globalglassonion.blogspot.com/...financial system. The average non-financial corporation in the US is sitting on a debt to equity ratio of 105%. Bank leverage while relatively low compared to Europe (13 vs. 25) ...

Related Video with debt to equity ratio equation

debt to equity ratio equation Video 1

debt to equity ratio equation Video 2

debt to equity ratio equation Video 3