About 'debt and equity underwriting'|Carlton Raises $600 Million of Equity and Debt Amidst Capital Markets Mess

Investors often find lenders' requirements for title seasoning an obstacle to selling their properties. Holding costs and declining market value can eat into profits. Leaving a house vacant can make it a target for vandalism. So... What is title seasoning? This refers to the length of time a person's name has been on the title document recorded on a piece of real estate. Lenders' underwriting guidelines vary as to how long a person's name must be on title for a purchaser to buy an investor's home or for the investor to refinance the property and cover his costs to rehab it. Why did lenders institute the title seasoning requirement? Can we say mortgage fraud? The scenario goes like this: Crook #1 buys a house for $100,000 in Week 1 and sells it to Crook #2 for $150,000 in Week #3. Crook #2 has his sister, brother-in-law, cousin Marvin appraise the property for $200,000 in Week #5 and in Week #6 sells it to Clueless Buyer who is so afraid of being priced out of a rapidly escalating housing market that she pays him a $25,000 premium over his asking price just to stay out of a bidding war. Problem is, Clueless Buyer is often a figment of some hot shot creative loan broker's imagination trying to score a commission, points on the loan or the yield spread premium from the lender. After a few hundred of these scenarios, lenders wised up and wanted to believe they could stop property flipping (which is not illegal). Hey, it worked great - right up until about 2003. This is the year many lenders started to find ways around their own underwriters' judgment and went to senior management for a "business decision" to get around loan/title seasoning in order to make their numbers for that month. Knee-jerk reactions by lenders looking down the barrel of Fed regulations have really hampered the efforts of honest investors who could instrumental in turning the mortgage markets around. You would think with the state of today's real estate market and high foreclosure rates, lenders would do away with the seasoning requirement all together to get the loans off their books. However, many lenders will not waive title seasoning requirements and have even extended them to 12 months or longer on properties, especially for non-owner occupied homes. Here some tips for dealing with those title seasoning requirements: 1) Good news! The FHA has put a temporary one-year moratorium (until July 2009) on title seasoning requirements in order to move the glut of foreclosed homes on the market. Even though this moratorium only applies to properties purchased because of foreclosure, many lenders will follow suit to clear their books of foreclosed properties. 2) Use a land trust agreement. If the seller still has equity in the property that he can't borrow against because of damaged credit, not enough qualifying income under the new guidelines, forthcoming judgments, or he/she simply wants to get out from under a burdensome payment and move on, educate this seller about the land trust and how it can benefit both of you. Once you acquire a beneficial interest in the trust, find a bank that will fund the trust and cash the seller out. This should leave the property marketable to your end buyer, who can then get new FHA financing. 3) Purchase the property with a contract for deed. This is a form of seller financing wherein you (or your assignee) will make installment payments to the seller with a promise to pay the loan in full at a later date. This is usually done by a seller who owns the property free and clear. However, though not as "in vogue" as the land trust right now, the land contract makes more economical sense to the lender (if the property is encumbered). Run a hypothetical scenario by the lender and see if they would prefer this to a short sale. 4) Buying "subject-to". In today's real estate market, many homeowners will still just hand you the deed to their property because they just aren't capable of carrying the payments anymore. You will want to establish if there is still equity in the property (the borrower may be deeply in debt, no longer has a job, or an illness forces him to give up the property.) and reinstate the loan by catching up any back payments and fees. To avoid triggering the due on sale clause, take out a second insurance policy with you as beneficiary, leaving the first insurance policy in tact. 5) Cash is king! Even a little bit of it will buy you some hard money to close a deal that can then be sold to a qualifying buyer with new conventional financing. Just remember that many hard lenders relying on foreign investment are a thing of the past. Either have plenty of equity in the property "as-is" or be prepared to put up some of your own money. At least they won't be picky about seasoning. 6) You can still buy low and sell high. You just need to justify your new higher selling price with invoices, receipts and contracts for work done or to be done. This is one way to satisfy the FHA's rules against (perceived) over-inflated flips, which will convince them to insure a loan to your end buyer 7) Buy an REO direct from a lender who is now into the FHA loan game. They own the property, you buy it and rehab it, and take them the borrower to get new FHA financing. This is a win-win-win situation. 8) Buy new construction standing inventory from distressed builders. They, or their lender, have to unload their properties. If you must hold it for a year or two, these properties will rent quicker than less desirable properties. That will definitely meet most lenders seasoning requirement! 9) Reverse many of these techniques to get new buyers into your newly acquired houses. If they work for you, make them work for your buyers - at a profit, of course. 10) Buy bigger properties!. Commercial lending is filling the gap where residential properties are falling out of favor. With many commercial lenders, 5 or more units can fly under their commercial underwriting guidelines. Find out what qualifications they are looking for and be prepared to prepare the figures for them to make your case. Seasoning is often not an issue with them; they are looking at the return on their investment in your project. |

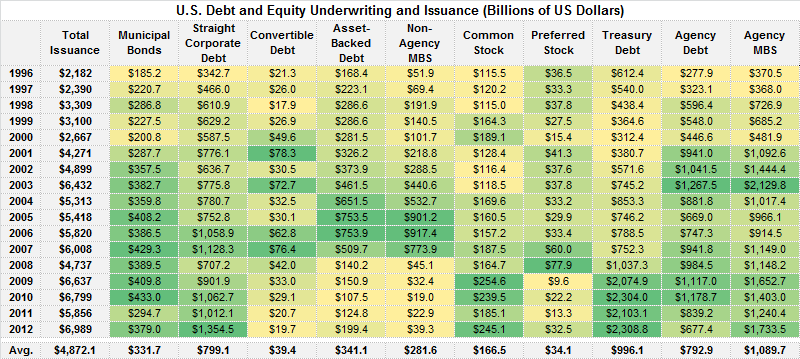

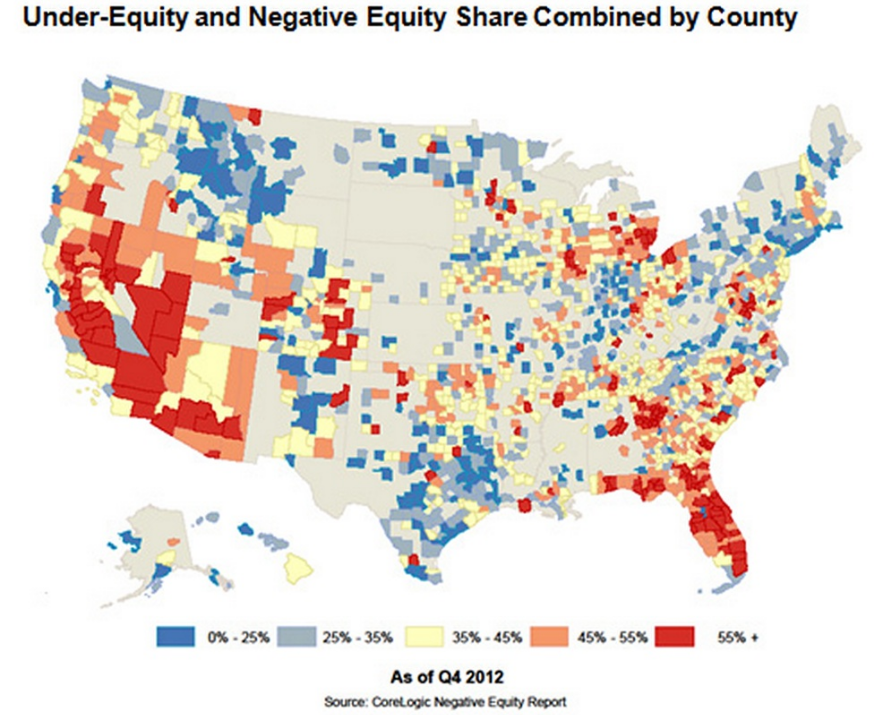

Image of debt and equity underwriting

debt and equity underwriting Image 1

debt and equity underwriting Image 2

debt and equity underwriting Image 3

debt and equity underwriting Image 4

debt and equity underwriting Image 5

Related blog with debt and equity underwriting

- carltongroup.wordpress.com/... and underwriting potential ... and capital raises...billion of investment sale, debt and equity assignments...

- thelobbylevel.wordpress.com/... in Chicago with both debt and equity panels. Here are a... with top flags and underwritten on T12 income to at most 65% LTV...

- zerohedge.blogspot.com/...satisfy their respective debt loads, let...3 billion JP Morgan and Bank Of America ... who are underwriting this travesty). This...Kimco raised equity , however without the...

- theautomaticearth.blogspot.com/... and acquisitions, and saw strong gains in both equity and debt underwriting.” Revenue was $5.4 billion, down 11 percent from the $6.1 billion a...

- epicureandealmaker.blogspot.com/...and sale of businesses and their assets), capital raising or "underwriting" (of equity, debt, etc.) on behalf of corporations...

- ironboxtrading.wordpress.com/...the first two months of the quarter from the same period last year, debt and equity underwriting totals have fallen. And trading has come...

- zaetsch.blogspot.com/...investment banking unit, which benefited from an increase in equity and debt underwriting fees. The bank's stock rose $1.01, or 0.6 percent, to $168.80 in...

- strategytoday.blogspot.com/...most of the major investment banking categories: M&A, Debt underwriting, and Equities. Morgan Stanley recently jumped 16 spots from ...

- theautomaticearth.blogspot.com/...help they offer will be in the form of a debt-for-equity swap or a waiver on banking .... More immediately, Taylor Wimpey and its advisers will be scouring...

- freekvermeulen.blogspot.com/...and securing the same companies as clients underwriting their debt and equity offerings or supporting their M&A activity. The ...

Related Video with debt and equity underwriting

debt and equity underwriting Video 1

debt and equity underwriting Video 2

debt and equity underwriting Video 3