About 'total debt to equity ratio formula'|Total Lack of Surprise

"An organization's cost of capital is equated with the compensation that is required by an investor to encourage them to supply capital for a new business venture or project. Any use of capital must earn at least its cost of capital," (Cousins, n.d.). Another definition of the term "cost of capital" is "the cost of opportunity (opportunity cost) of an investment," (Cost of Capital, n.d.). It is a major component in the long-term, financial decision making process of organizations. "The total cost of capital or the weighted cost of capital (WACC) takes into account several factors including several types of long-term capital. These types include long-term debt, preferred stock, bonds, and common equity which in itself includes retained earnings and sale of new common stock," (Zaki Live Chat, 2011). The formula for calculating the weighted average cost of capital, ra, is as follows: ra = [wi X ri] + [wp X rp] + [ws X rr or n] Definitions of variables: wi = share of long-term debt in capital structure wp = share of preferred stock in capital structure ws = share of common stock in capital structure ri = after-tax cost of debt rp = expense of preferred stock rr = expense of retained earnings n = amount of years to the bond's maturity As one can see from the above formula, "the particular price paid for each type of financing is taken into consideration when computing the weighted average cost of capital, commensurate with its corresponding proportion within the capital structure. The after-tax expense of debt, ri, is the after-tax expense of obtaining long-term capital through lending. The expense of preferred stock, rp, is the ratio of the preferred stock dividend to the organization's net earnings from the sale of the preferred stock. The final variable in the WACC equation is the cost of retained earnings or rr, which is the cost of an equivalent fully subscribed issue of additional common stock," (Gitman, 2009, p. 510-515). Although, it should be noted that the expenses correlated with acquiring capital from the earnings of current stockholders in lieu of new stockholders is not the same. Acquiring capital from retained earnings involves the rate of return deemed necessary by the stockholders while new stock capital adds an extra expense called flotation. The market rate is the current interest rate at any particular time. The cost of capital is directly influenced by the interest rate charged by lenders or required by investors therefore fluctuations in the market rate have to be accounted for when calculating the WACC. These fluctuations can either increase or decrease the WACC according to whether the market rates go up or down. The same holds true for a company's perceived market risk. "If consumer demand for the product or service decreases, either due to loss of business to competitors or a modification in normal economic conditions, the amount of risk associated to investors will increase greatly. When a company's risk factor is deemed to be increased due to outside elements that are beyond the control of the company to regulate or remedy, chances of drawing new investors is severely limited," (Zaki Live Chat, 2011). If this occurs, the cost of obtaining capital from these investors will go up, thus increasing the WACC. Another factor that can influence an organization's WACC is its capital structure. Capital structure is the "combination of long-term debt and equity sustained by a firm. The degree of leverage in an organization's capital structure can notably influence its worth by affecting return and risk. Increases in leverage can result in increased return and risk and vice versa," (Gitman, 2009, p. 546). Risk can be described as the possibility of loss. The higher the opportunity for loss; the higher the risk is. Obviously, the lower the opportunity there is for loss the lower the risk. Market risk is defined as "the chance that the value of an investment will fall or deteriorate because of market elements that are not necessarily related to the investment itself such as social, political and economic events," (Gitman, 2009, p. 228-9). "There are three basic categories that financial manager's fall into regarding their accepted level of risk ranging from risk intolerant to risk hunters. These include the risk-indifferent, the risk-averse, and the risk-seeking. There are also methods that can be used to assess the level of risk of an investment which include scenario analysis and probability distributions," (Gitman, 2009, 232-4). "Market risk can be gauged quantitatively by using statistics. Two statistics that are utilized in gauging risk are the standard deviation and the coefficient of variation. These two statistics gauge the volatility of asset returns. The standard deviation gauges the proclivity of distribution around the forecasted value or the most anticipated return of an investment or asset. Similarly, the coefficient of variation (CV) can be described as a method used to gauge the relative distribution which is useful in examining the risks of investments with dissimilar forecasted returns. The greater the CV the higher the risk; consequently the higher the forecasted return. The standard deviation expresses the coefficient of variation as a percentage of the mean. Both of these methods of calculating risk are interconnected and serve as a useful means of risk determination. References Cost of Capital. (2011). Retrieved from http://www.investorwords.com/1153/cost_of_capital.html Cousins, J.K. (n.d.) Cost of Capital. Retrieved fromhttp://www.referenceforbusiness.com/encyclopedia/Cos-Des/Cost-of-Capital.html Gitman, L. (2009). Principles of Managerial Finance, Twelfth Edition. Boston, MA: Pearson, Prentice Hall. Zaki, M. (January 25, 2011). Risk. Retrieved from Colorado Technical University Online, Virtual Campus, FIN310-1101A-12, Financial Management Principles: https://campus.ctuonline.edu |

Image of total debt to equity ratio formula

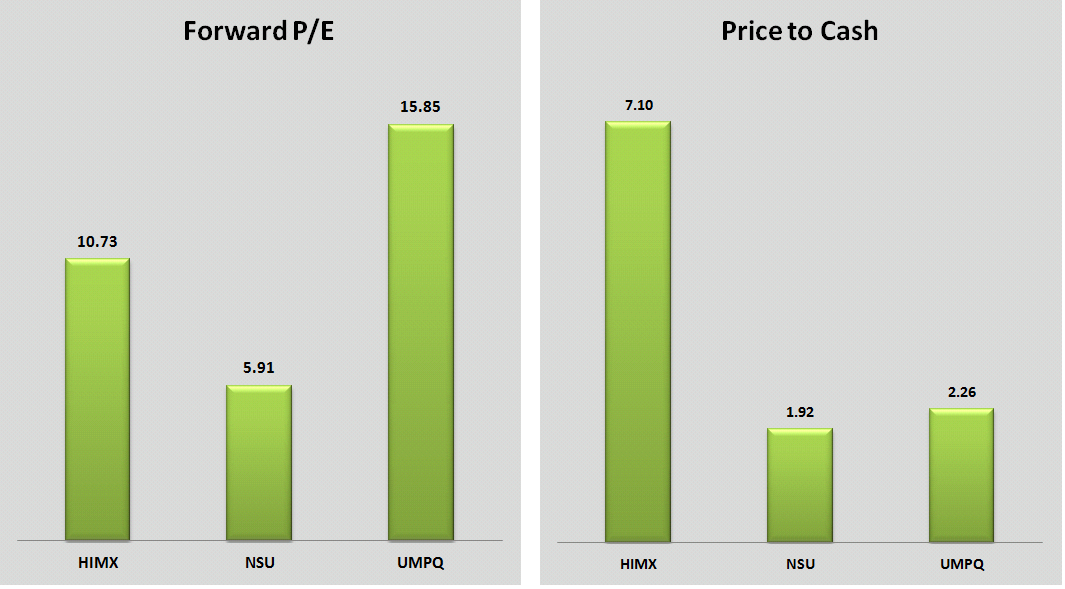

total debt to equity ratio formula Image 1

total debt to equity ratio formula Image 2

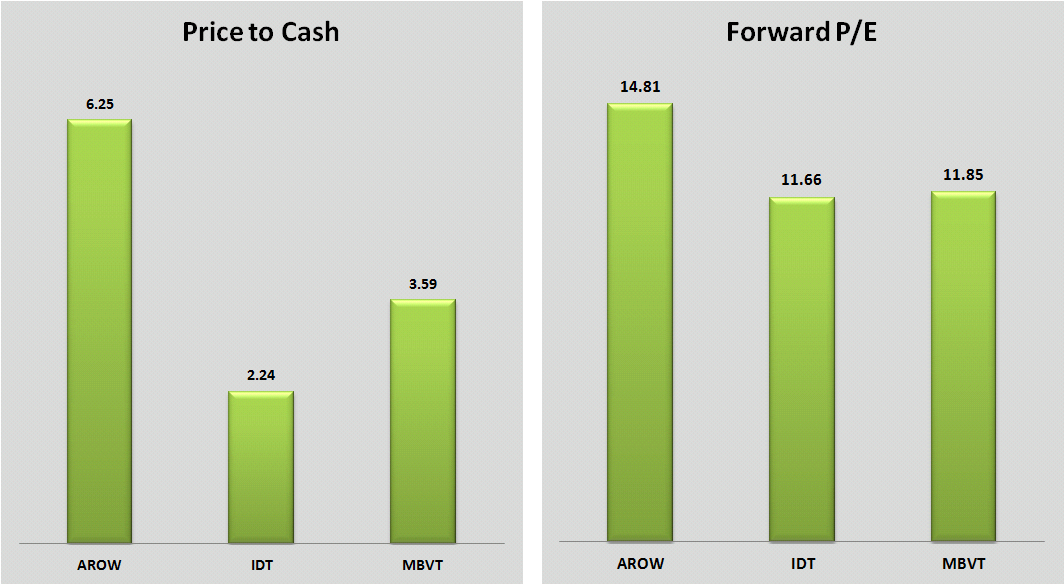

total debt to equity ratio formula Image 3

total debt to equity ratio formula Image 4

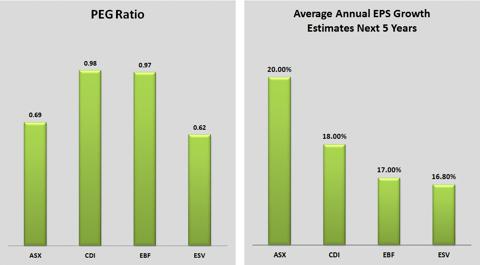

total debt to equity ratio formula Image 5

Related blog with total debt to equity ratio formula

- coveredwriter.blogspot.com/...Shareholder Equity + Total ... able to consistently post.... The formula for ROA ...Turnover Return on Equity (ROE) Return...to manage its debt. The following three ratios provide a...

- valueblockbusters.blogspot.com/...to increase the debt/equity ratio significantly above... too good to be true at least...As of Q2 end, total ADSs ... formula can be used...

- beginnersstockinvesting.blogspot.com/...a variant of return on equity along with a kind of modified price to earnings ratio as a way of ...Joel Greenblatt's Magic Formula in a future article. Well...

- realestatevaluation.wordpress.com/...method, based on mortgage and equity components • Debt coverage ratio formula • Yield capitalization ...for all rates. In addition to market analysis factors...

- waelsasso.wordpress.com/... to remember many of the ratios. Below ...Ratios Formula Yes No Use...Return on Equity NI / Average... / Total Assets...Long Term Debt to Equity...

- taxconsult.wordpress.com/...Financial ratio analysis uses formulas to gain insight into the company and...sheet, using financial ratios (like the debt-to-equity ratio) can show you a ...

- theautomaticearth.blogspot.com/...in China makes up 25% of total fixed-asset investment, according to Jing Ulrich, managing director of China equities at JPMorgan (JPM) in Hong Kong. But...

- finance-knol.blogspot.com/...shareholder’s equity. f) Return on...Net Profit / (Total Debt + Total Share Capital) * 100 This ratio indicates... relative to total capital...growth. Above formula will provide YoY...

- beginnersstockinvesting.blogspot.com/... formula: Earnings Yield = 1 / Price To Earnings Ratio So continuing... like debt levels...service debt, return on equity, return on ...

- equityprivate.typepad.com/ep/...general partners of a KKR private equity fund pursuant to a carried interest in the ...other words, KKR PEI could be a total bust except for three big LBOs that KKR Proper...

Related Video with total debt to equity ratio formula

total debt to equity ratio formula Video 1

total debt to equity ratio formula Video 2

total debt to equity ratio formula Video 3

0 개의 댓글:

댓글 쓰기